Get a pulse on your

business’s financial health

Join the millions of small business owners using Nav to improve their business financial health to access the funding options they need to run their business.

Get Started

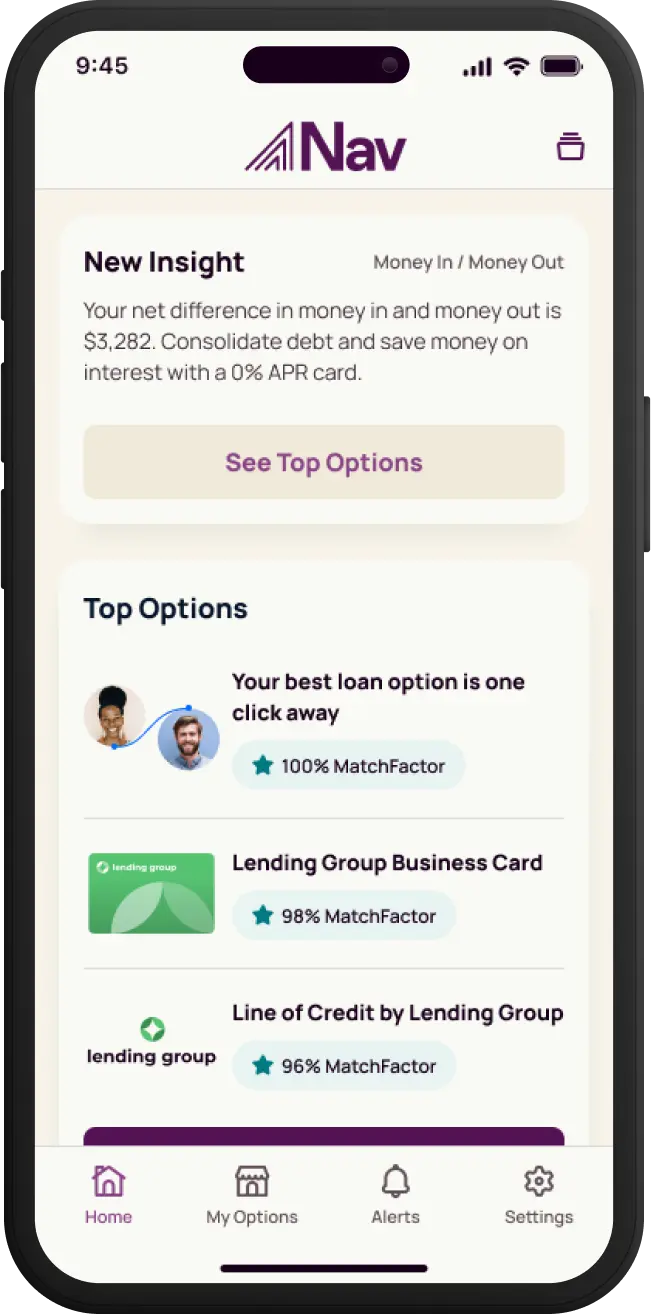

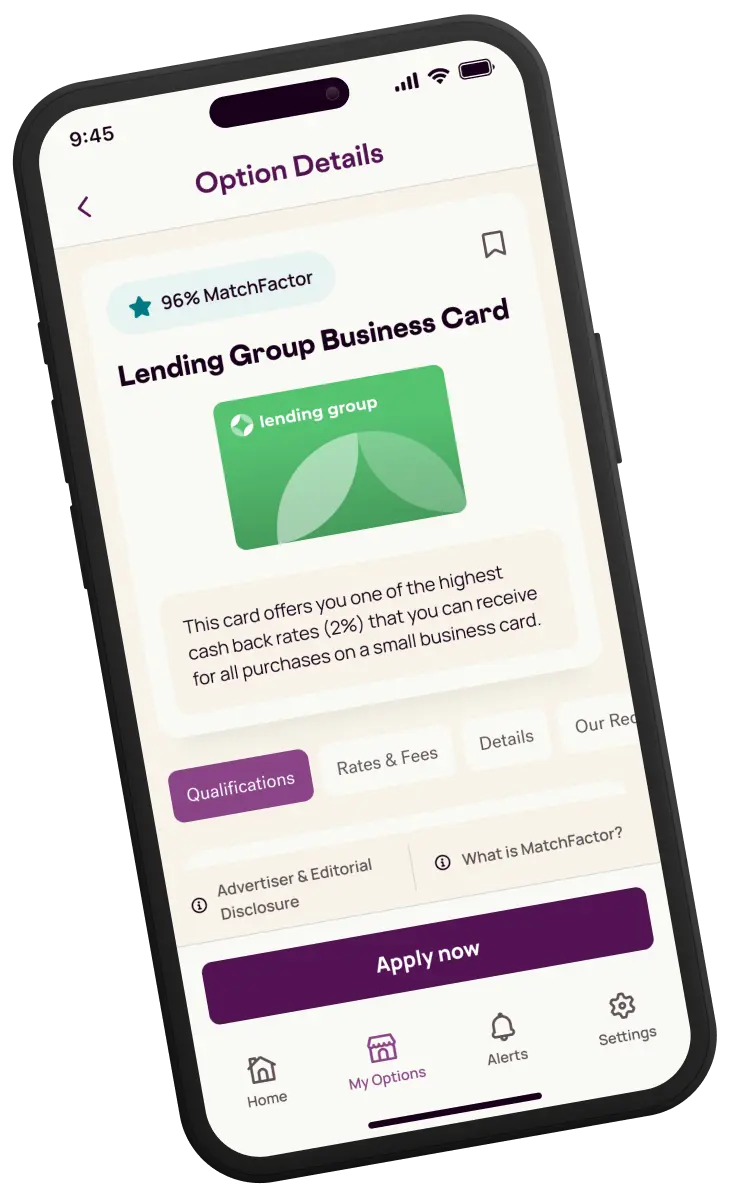

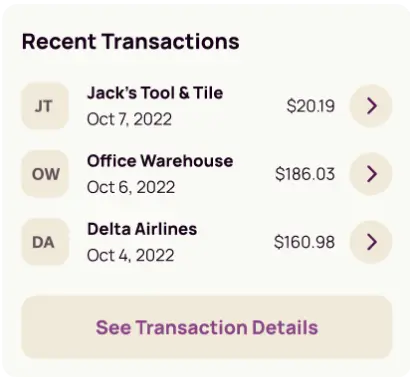

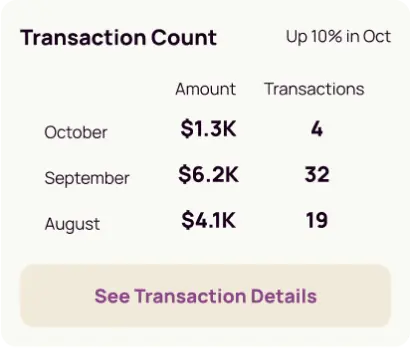

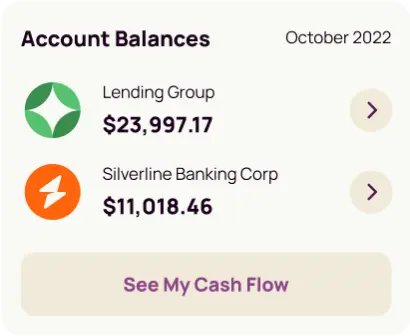

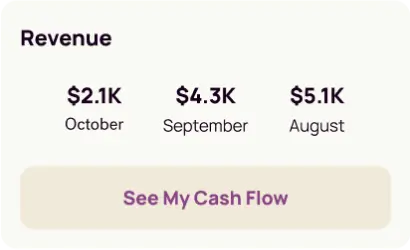

Financial health for your small business, in your pocket

By connecting to your financial health you can understand where your business stands today, what your options are, and how to move your business forward.

Let's Get Started

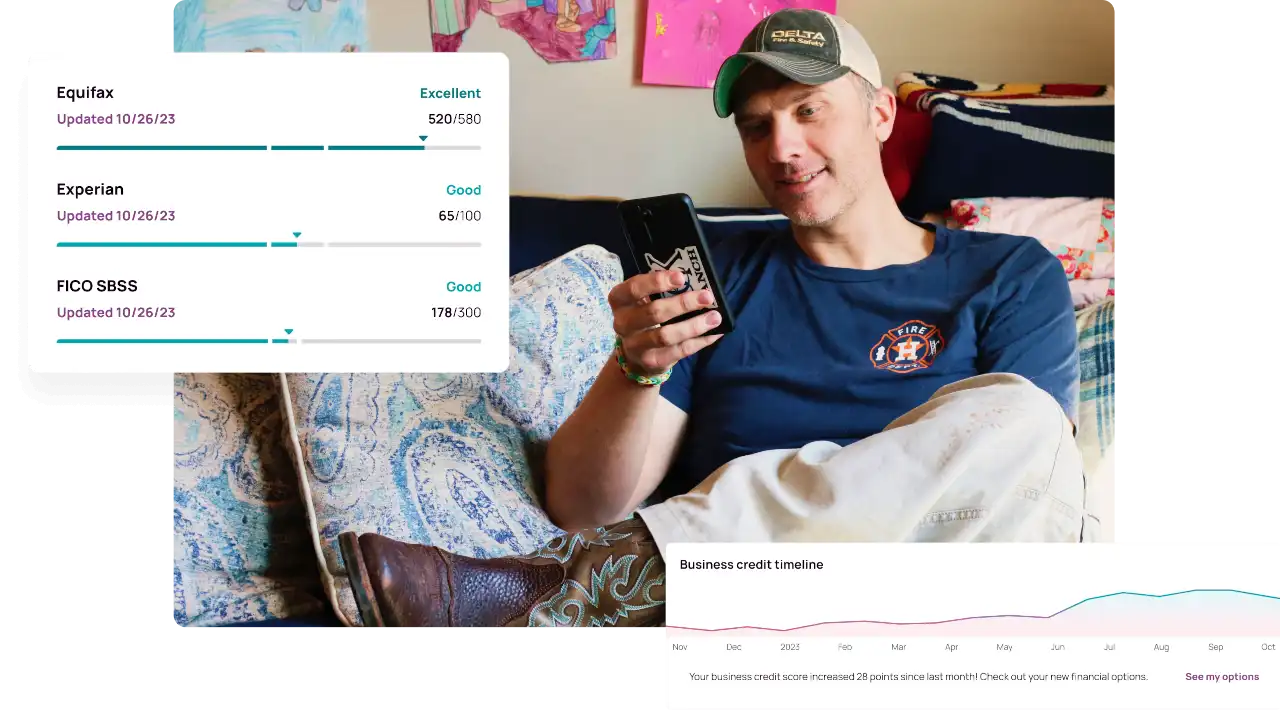

Drive your business’s performance with Nav insights

Get Insights

Build Business Credit by Keeping Cash Flow High and Overhead Low

Read More

The Role of Credit Scores in Securing Business Financing: What You Need to Know

Read More

Can You Use a HELOC to Start a Business? Pros, Cons, and Alternatives

Read More

Do Subscriptions Build Business Credit?

Read More

How This Wellness Center Owner Used Funding to Grow With Confidence

Read More

The Biden Plan to Cap Credit Card Late Fees and Does It Apply for Business Cards?

Read MoreFinancial health for your small business

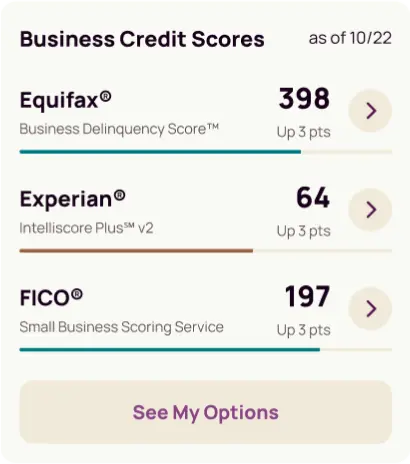

I'm Ready¹Based on aggregate data tracking Experian® Intelliscore Plus business credit scores after three months of having Nav tradeline reporting. Results will vary. Scores are calculated from many variables; some users may not see improved scores.